Solar Loans & Financing in New York: How to Afford Solar Energy in the Empire State

If you live in New York, you already know electricity isn’t cheap — and it’s not getting any cheaper. According to the U.S. Energy Information Administration, New Yorkers pay some of the highest electricity rates in the country.

Add in unpredictable weather, power outages, and the growing push toward clean energy, and it’s no wonder more households are switching to solar.

But there’s one big question: How do you pay for it?

This guide covers the best solar loan and financing options in New York, from state-backed programs to flexible private financing, so you can start generating clean power without draining your savings.

Why Financing Solar in New York Makes Sense

solar in New York has unique financial perks:

High energy rates – means your monthly savings from solar are even bigger.

Strong state incentives – including NY-Sun, the NYSERDA Solar Loan Program, and local utility rebates.

Property value boost – buyers are willing to pay more for homes with existing solar.

Long-term cost control – solar locks in your energy costs for decades.

Best Solar Loan & Financing Options in New York

These are widely used $0-down and low-down financing options available to New York homeowners. Review terms, compare features, and apply via each provider’s official site linked below.

| Provider | Program Type | Typical Terms | Why New Yorkers Use It | Official Site |

|---|---|---|---|---|

|

NYSERDA / NY-Sun State Program Loan & Incentives |

State-backed financing programs, incentive coordination, and loan referrals | Varies by program; NYSERDA partners with local lenders for favorable terms | State-specific incentives, direct rebates, and approved loan programs for eligible homeowners | Visit NY-Sun (NYSERDA) |

|

NY Green Bank Green Bank Wholesale Finance |

Public bank providing capital to lenders & installers for clean energy projects | Supports projects via lending partners; terms depend on partner | Catalyzes lower-cost capital and increases lender options in New York | Visit NY Green Bank |

|

Mosaic Solar Loans $0 Down |

Fixed-rate residential solar loans (often offered via installers) | 5–25 years depending on product & credit | Competitive APRs, national installer network that includes many NY-based contractors | Visit Mosaic |

|

Sungage Financial Installer Financing Solar Loans |

Loan programs offered through approved participating contractors | 10–25 years (product dependent) | Streamlined approvals and commonly offered by NY installers for $0-down offers | Visit Sungage Financial |

|

Loanpal Solar Loans Fast Funding |

Consumer-focused solar financing via installer network | Up to 20–25 years; flexible payment options | Quick underwriting and a large network of New York installers offering Loanpal financing | Visit Loanpal |

|

Local NY Credit Unions & Community Banks Local Loans Competitive Rates |

Home improvement & green energy loans through local financial institutions | Varies; often competitive when paired with NYSERDA incentives | Personalized service, often better rates for existing members, local knowledge of NY incentives | Find NY Credit Unions |

Note: APRs, terms, available products, and program eligibility depend on credit profile, installer partnerships, and location in New York. PACE availability, state rebates, and NYSERDA programs can change—always confirm current terms on the provider’s official site and consult a tax advisor for incentive guidance.

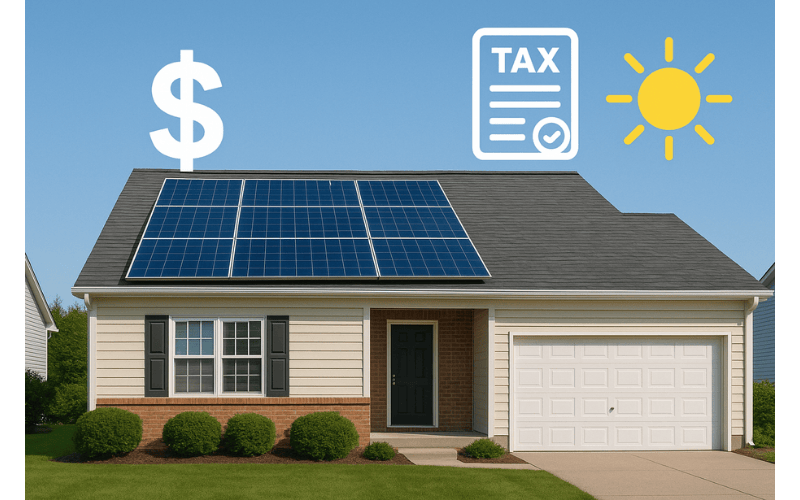

Solar Incentives in New York You Shouldn’t Miss

NY-Sun Megawatt Block Incentive – upfront cash incentives per watt installed.

Federal Solar Investment Tax Credit (ITC) – 30% tax credit on the total system cost.

NY State Solar Equipment Tax Credit – up to $5,000 back on your state taxes.

Property Tax Exemption – solar installations are exempt from property tax increases.

Sales Tax Exemption – no state sales tax on eligible solar equipment.

Tips for Choosing the Right Solar Financing in New York

1. Compare total lifetime costs – not just monthly payments.

2. Check eligibility for state-backed loans – they often have better rates.

3. Bundle with incentives – apply rebates and tax credits early to reduce your loan amount.

4. Avoid predatory lenders – stick with NYSERDA-approved or reputable solar lenders.

Frequently Asked Questions

Q: Can I get a solar loan with bad credit in New York?

A: Yes, some local credit unions and state-backed programs may approve you with lower credit, though your interest rate might be higher.

Q: Are there any zero-down solar loans in New York?

A: Yes, lenders like Mosaic and Sungage offer $0 down options for qualified homeowners.

Q: Can renters in New York benefit from solar loans?

A: Direct solar loans are usually for homeowners, but renters can join community solar programs.

Q: How long do NYSERDA loans take to process?

A: Usually 2–4 weeks from application to funding.

Thinking of going solar and want help quantifying your savings? Get our free eBook on "How to Slash Your Energy Bills with a Solar Generator (Even If You Rent)". Here!

About the author

Emayoma Abbey

Email: info@solarpawa.com

Emayoma Abbey is the founder of SolarPawa.com, a platform dedicated to empowering individuals and communities to embrace clean, reliable, and affordable solar energy. With a strong passion for solving real-world power challenges, Emayoma focuses on providing practical, easy-to-understand information that helps people take control of their energy needs.

ABOUT

SolarPawa is Nigeria's trusted online store for affordable and reliable solar energy solutions.

Created with © Emayoma Abbey