How to Maximize the Residential Clean Energy Credit for Solar Before It Expires

What Is the Residential Clean Energy Credit?

The Residential Clean Energy Credit is a federal tax credit — meaning it directly reduces the amount of federal income tax you owe, dollar-for-dollar.

Covers 30% of the cost of installing renewable energy systems like solar, wind, geothermal, and fuel cells.

For solar, it applies to both solar panels and solar batteries (energy storage).

There’s no cap on the amount you can claim — whether your system costs $10,000 or $100,000, you still get 30%.

Key detail: This is a credit, not a deduction. A deduction lowers your taxable income; a credit lowers your tax bill.

Why Solar Is the Biggest Winner

While the credit covers multiple clean energy types, solar tends to have the highest return on investment for homeowners.

Why?

Solar panels can cut electricity bills by 50–100%.

Many states allow net metering, where you sell excess power back to the grid.

Adding a battery can protect against blackouts.

With electricity prices rising in most U.S. states, the upfront cost of solar gets paid back faster — especially when 30% of that cost comes off your tax bill.

Credit Timeline: When It Drops and Why That Matters

This means:

Install in 2025 → $20,000 system = $6,000 credit

Install in 2033 → same system = $5,200 credit

Wait until 2035 → $0 credit

Delaying just a couple of years can cost you thousands — and installation demand may spike as the deadline approaches.

Full List of Solar Expenses That Qualify

Eligible:

Solar photovoltaic (PV) panels

Inverters

Racking and mounting equipment

Balance-of-system wiring, conduits, and hardware

Energy storage devices (batteries ≥ 3 kWh capacity)

Labor for site prep, assembly, and installation

Permitting fees directly tied to installation

Sales tax on eligible equipment

Not Eligible:

Roof replacement (unless structural changes are solely to support solar)

Solar pool heaters or decorative fountains

Portable solar devices for RVs or boats (unless they meet IRS criteria for home use)

How the Credit Works: A Simple Example

Scenario:

Solar system cost: $22,000

Battery storage cost: $8,000

Total: $30,000

30% credit = $9,000

If your total federal tax bill is $7,000, the credit will:

Reduce your owed tax to $0

Carry over the remaining $2,000 to the following tax year

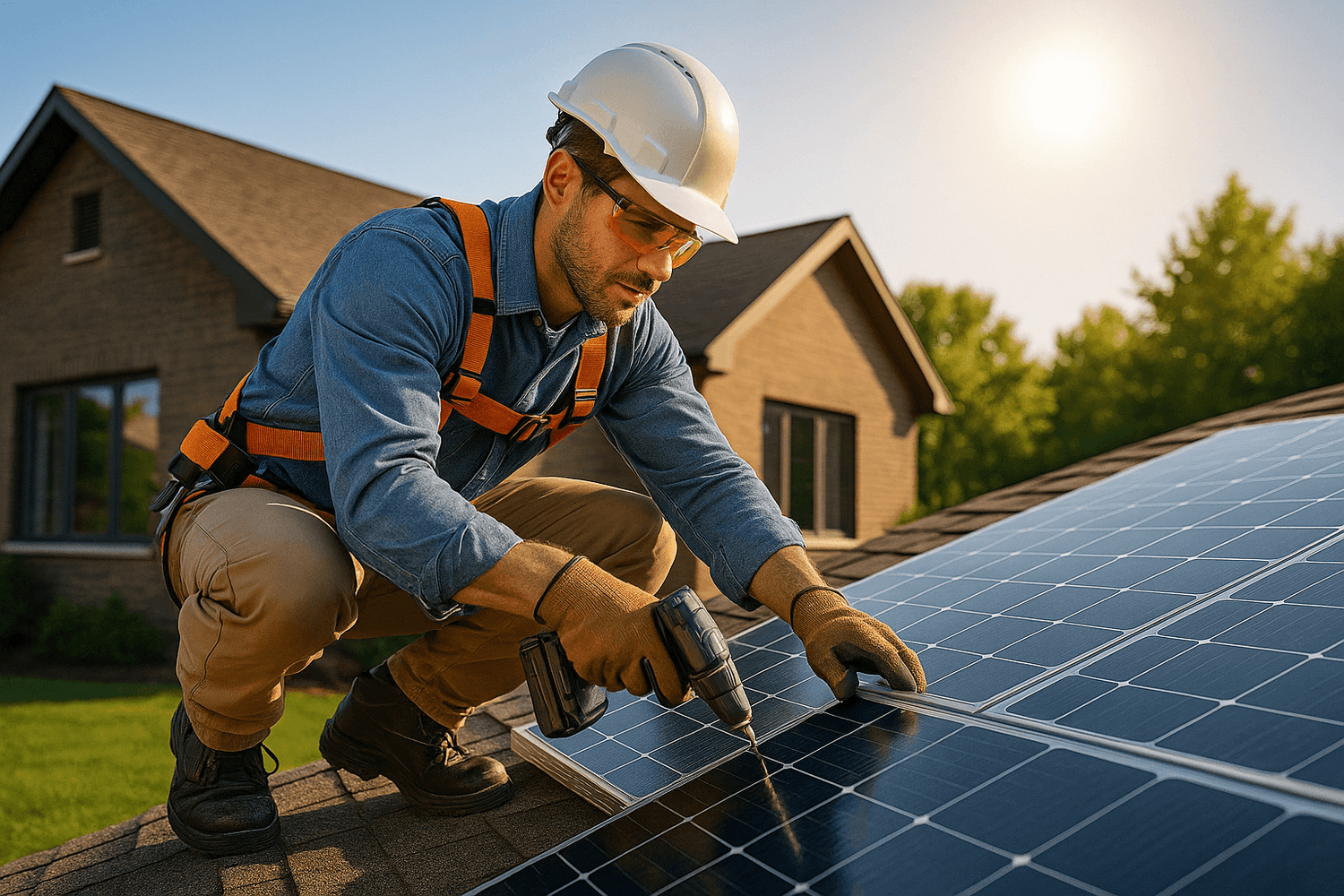

How to Claim the Credit: Step-by-Step

Hire a certified installer — check NABCEP certification and state licensing.

Sign your contract early — supply chain issues can cause delays.

Install and activate your system before December 31 of your target year.

Save all receipts — include invoices for panels, batteries, labor, and permits.

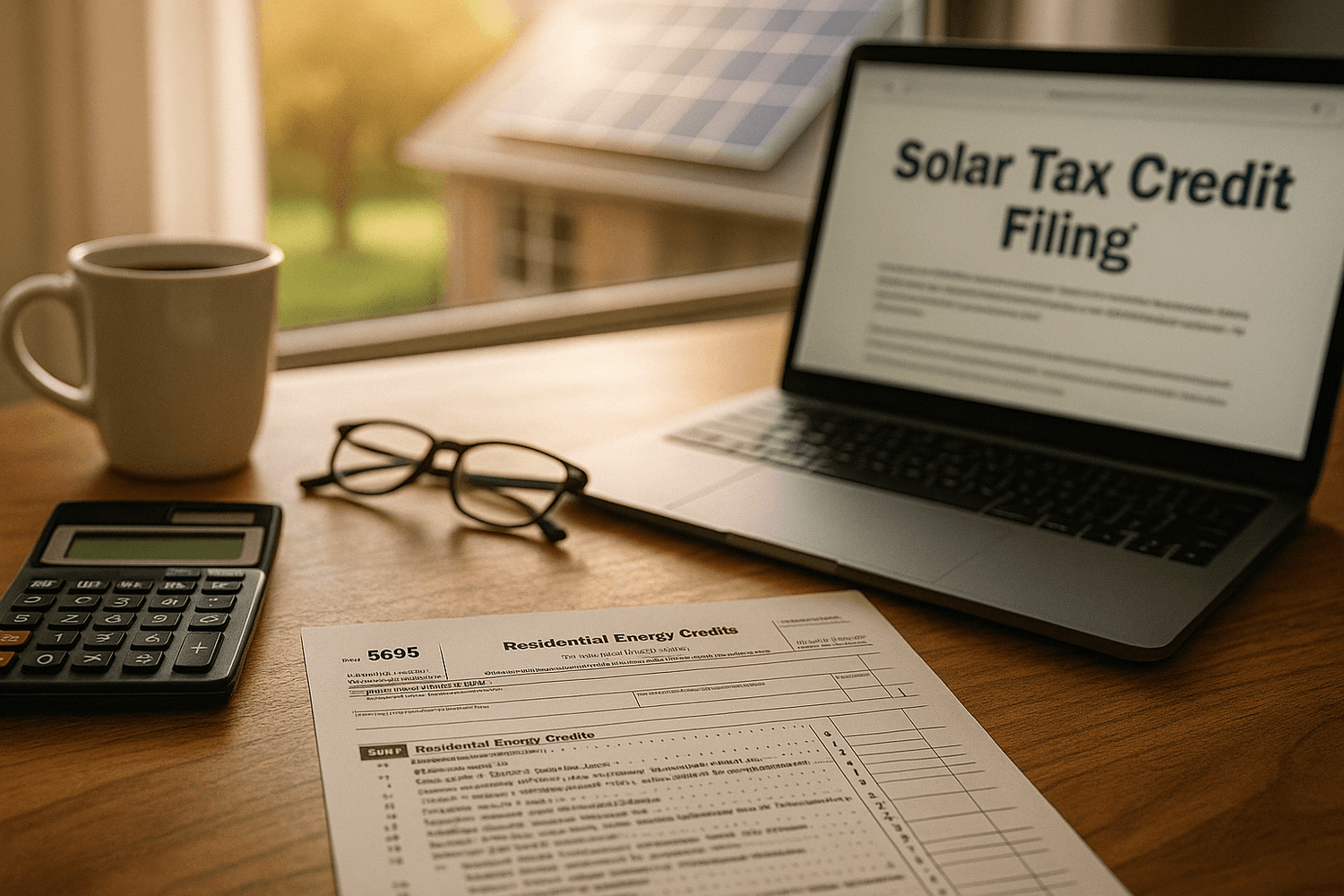

File IRS Form 5695 with your federal tax return.

Apply the credit to reduce your tax bill.

Tip: Some installers offer paperwork assistance to make sure you don’t miss a step.

Deadlines and IRS Filing Rules

The installation must be complete in the same tax year you claim the credit.

For 2025 installs, claim on your 2025 tax return (due April 15, 2026).

The credit can be carried forward if it’s larger than your tax bill.

Pro Strategies to Maximize Your Credit

Combine installation with battery storage for greater savings.

Time your install early in the year to beat contractor backlogs.

Use state rebates and utility incentives alongside the federal credit.

Consider financing options that let you pay after you receive your tax refund.

If your home needs upgrades for solar, ensure they’re integrated into the eligible cost.

Stacking Federal, State, and Local Incentives

The federal credit is great, but stacking incentives is where real savings happen.

Examples:

California – Self-Generation Incentive Program (SGIP) for batteries

New York – NY-Sun rebate program

Massachusetts – SMART program for monthly performance payments

Find your state’s programs: DSIRE Incentive Database

Common Mistakes That Cost Homeowners Thousands

Waiting until the last quarter of the year → high demand and possible delays.

Forgetting to include sales tax in the credit calculation.

Using unlicensed contractors.

Assuming the credit is a cash rebate — it’s a tax reduction.

The Residential Clean Energy Credit is at its strongest now — and for homeowners considering solar, the smartest move is to act before it begins phasing out in 2033.

By installing now, you’ll:

Lock in the full 30% savings

Reduce your utility bills

Increase your property value

Support a cleaner energy future

Thinking of going solar and want help quantifying your savings? Get our free eBook on "How to Slash Your Energy Bills with a Solar Generator (Even If You Rent)". Here!

About the author

Emayoma Abbey

Email: info@solarpawa.com

Emayoma Abbey is the founder of SolarPawa.com, a platform dedicated to empowering individuals and communities to embrace clean, reliable, and affordable solar energy. With a strong passion for solving real-world power challenges, Emayoma focuses on providing practical, easy-to-understand information that helps people take control of their energy needs.

ABOUT

SolarPawa is Nigeria's trusted online store for affordable and reliable solar energy solutions.

Created with © Emayoma Abbey