How to Boost Credit Score Before Applying for a Solar Loan

Why Your Credit Score Matters for a Solar Loan

Switching to solar energy is one of the smartest financial moves a U.S. homeowner can make — but if you’re planning to finance your system with a solar loan, your credit score plays a huge role in approval odds and interest rates.

A high credit score can mean:

1. Lower interest rates (saving you thousands over the loan term)

2. Higher approval chances from banks and solar financing companies

3. Better terms, such as no prepayment pena

lties

Conversely, a low score can lead to loan denials or significantly higher monthly payments. The good news? With the right strategy, you can raise your credit score in just a few months before applying.

Understanding Solar Loans in the U.S.

In the United States, most solar loan providers look for a minimum FICO score of 650–700, though some accept lower scores at higher interest rates. There are two main types:

1. Secured Solar Loans – Tied to your property or other collateral. Often have lower interest rates but may involve liens.

2. Unsecured Solar Loans – No collateral required but typically have higher interest rates.

Common U.S. lenders and financing programs include: Mosaic, Sungage Financial, LightStream, and local credit unions. Many also factor in your debt-to-income ratio in addition to credit score.

Step 1: Check Your Current Credit Score

Before making improvements, you need a baseline. Every U.S. consumer is entitled to a free credit report from each bureau (Experian, Equifax, TransUnion) once per year at AnnualCreditReport.com.

You can also check your FICO score for free via some credit card companies, banks, or apps like Credit Karma (note: these often use VantageScore, which may differ from FICO).

Tip: Lenders usually use FICO Score 8 or FICO Score 2/4/5 for mortgages and similar large loans.

Step 2: Pay Down Credit Card Balances

One of the fastest ways to improve your score is lowering your credit utilization ratio — the percentage of your available credit you’re using.

1. Aim for under 30% utilization (under 10% is ideal).

2. Pay off high-interest cards first.

3. If possible, make two payments per month to keep balances low between statement cy

cles.

Example: If your card has a $5,000 limit, try to keep your balance under $1,500 at all times.

Step 3: Avoid New Debt or Hard Inquiries

Every time you apply for new credit, a hard inquiry appears on your report, which can temporarily lower your score by 5–10 points.

In the 3–6 months before applying for a solar loan:

1. Avoid new credit cards or personal loans

2. Don’t finance big purchases (cars, appliances) unless absolutely necessary

3. Hold off on store financing o

ffers

Step 4: Make All Payments On Time

Your payment history makes up 35% of your FICO score — the largest single factor. Even one 30-day late payment can cause a big drop.

1. Set up autopay for all bills (credit cards, utilities, student loans, mortgage)

2. Use payment reminders or calendar alerts

3. If you’ve missed payments in the past, get current and stay current — the older the late payment, the less it impacts your s

core

Step 5: Dispute Errors on Your Credit Report

According to the FTC, about 1 in 5 Americans has an error on their credit report. These can drag your score down unnecessarily.

Check for:

1. Accounts you don’t recognize

2. Incorrect balances or payment histories

3. Accounts listed as “late” that were paid on

time

Check for:

1. Accounts you don’t recognize

2. Incorrect balances or payment histories

3. Accounts listed as “late” that were paid on

time

File disputes directly with the bureau reporting the error:

Step 6: Keep Old Accounts Open

The length of your credit history makes up 15% of your FICO score. Closing old accounts can shorten your history and raise your utilization ratio.

Keep your oldest credit cards open, even if you rarely use them

Make a small purchase every few months to keep them active

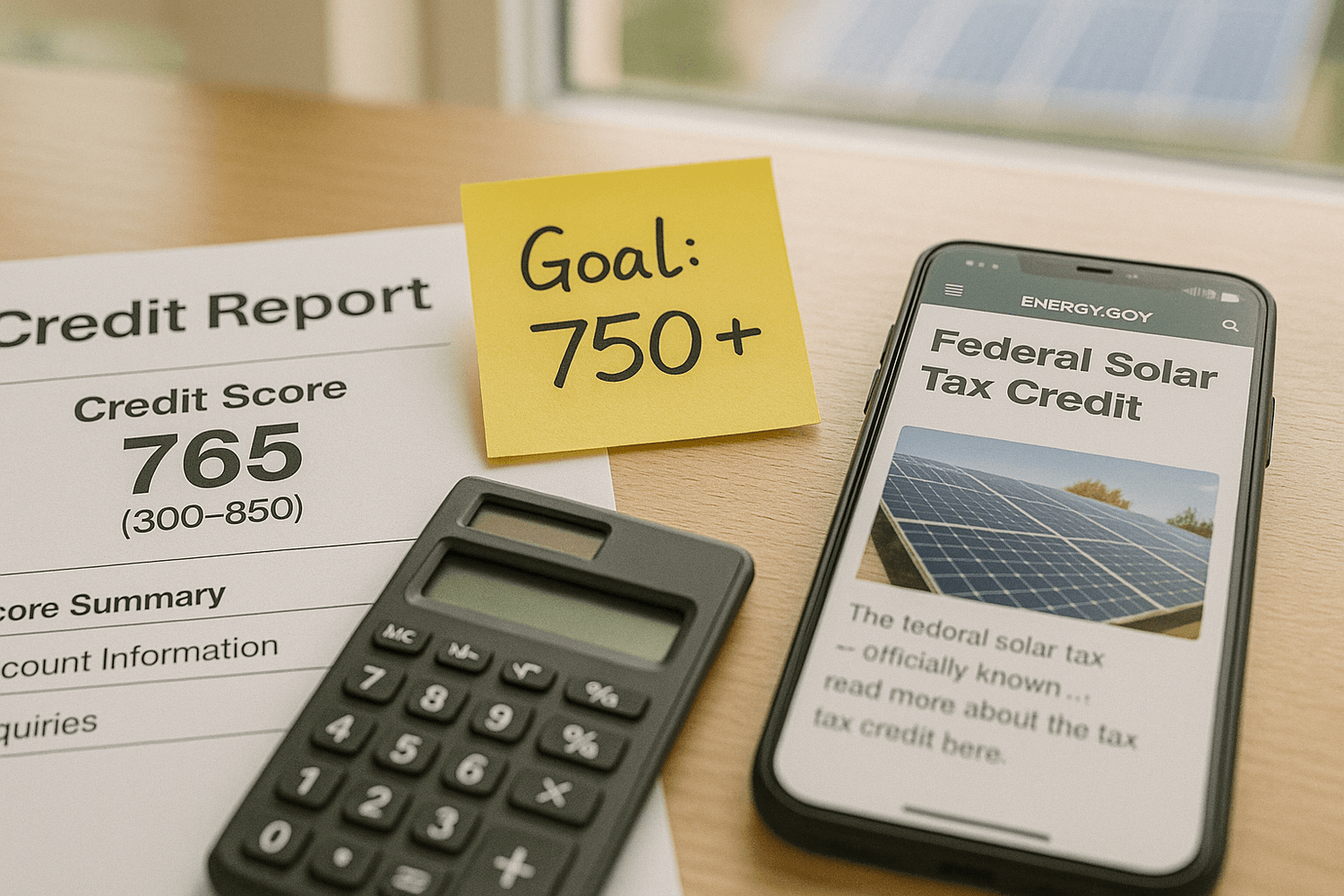

How Long Will It Take to See Improvements?

In most cases, you can see noticeable improvements in 30–90 days, depending on the actions you take. Disputing errors and paying down utilization can have a faster impact than building a longer payment history.

If your score is below 650, start working on improvements at least 6 months before applying for your solar loan.

Frequently Asked Questions

Q1: What credit score do you need for a solar loan in the U.S.?

Most lenders prefer 650+, but for the best interest rates, aim for 700 or higher.

Q2: Can I get a solar loan with bad credit?

Yes, but you’ll likely face higher interest rates and may need a co-signer or larger down payment.

Q3: Will installing solar panels improve my credit score?

Indirectly, yes — making consistent, on-time payments on your solar loan can help your score over time.

Q4: Do solar incentives require a certain credit score?

No, incentives like the Residential Clean Energy Credit are available regardless of credit score, but you still need financing approval if you’re not paying upfront.

Get Ready for Solar Savings

A strong credit score can save you thousands over the life of your solar loan.

By checking your score early, paying down balances, avoiding new debt, making all payments on time, disputing errors, and keeping old accounts open, you’ll be well-positioned for fast approval and the lowest rates possible.

With solar prices dropping and federal incentives like the Residential Clean Energy Credit still in place, now is the perfect time to prepare — both financially and credit-wise — for your clean energy future.

Thinking of going solar and want help quantifying your savings? Get our free eBook on "How to Slash Your Energy Bills with a Solar Generator (Even If You Rent)". Here!

About the author

Emayoma Abbey

Email: info@solarpawa.com

Emayoma Abbey is the founder of SolarPawa.com, a platform dedicated to empowering individuals and communities to embrace clean, reliable, and affordable solar energy. With a strong passion for solving real-world power challenges, Emayoma focuses on providing practical, easy-to-understand information that helps people take control of their energy needs.

ABOUT

SolarPawa is Nigeria's trusted online store for affordable and reliable solar energy solutions.

Created with © Emayoma Abbey