How Solar Financing Makes Going Solar Affordable in California (No Upfront Cost Required)

Here’s the good news: you don’t need to pay tens of thousands upfront to go solar anymore.

Thanks to flexible financing options, you can install panels with little to no money down, start saving on your energy bills immediately, and pay for your system over time.

Why California Homeowners Are Turning to Solar

California is blessed with sunshine almost year-round, but it also has some of the highest utility rates in the U.S. In fact, California residential electricity prices are around 33 cents per kilowatt-hour, which is nearly 80% higher than the national average of 18.5 cents/kWh (EIA, 2025).

When you add in PG&E and SCE’s 2025 rate hikes, many households are seeing their bills jump by $30–$50 or more per month, making solar not just environmentally smart — but financially necessary.

How Solar Financing Works

Solar financing lets you avoid the big upfront cost. Here are the main options:

1. Solar Loans – You borrow money to pay for the system, then repay monthly (similar to a car loan). The panels belong to you, and you still qualify for tax credits.

2. Solar Leases – You rent the panels from a solar company. They install and maintain everything, and you pay a fixed monthly fee (usually less than your utility bill).

3. Power Purchase Agreements (PPAs) – Instead of buying the panels, you agree to purchase the electricity they generate at a locked-in rate that’s cheaper than your utility.

With each of these, you can get started with little or no upfront cost, and immediately lower your PG&E or SCE bill.

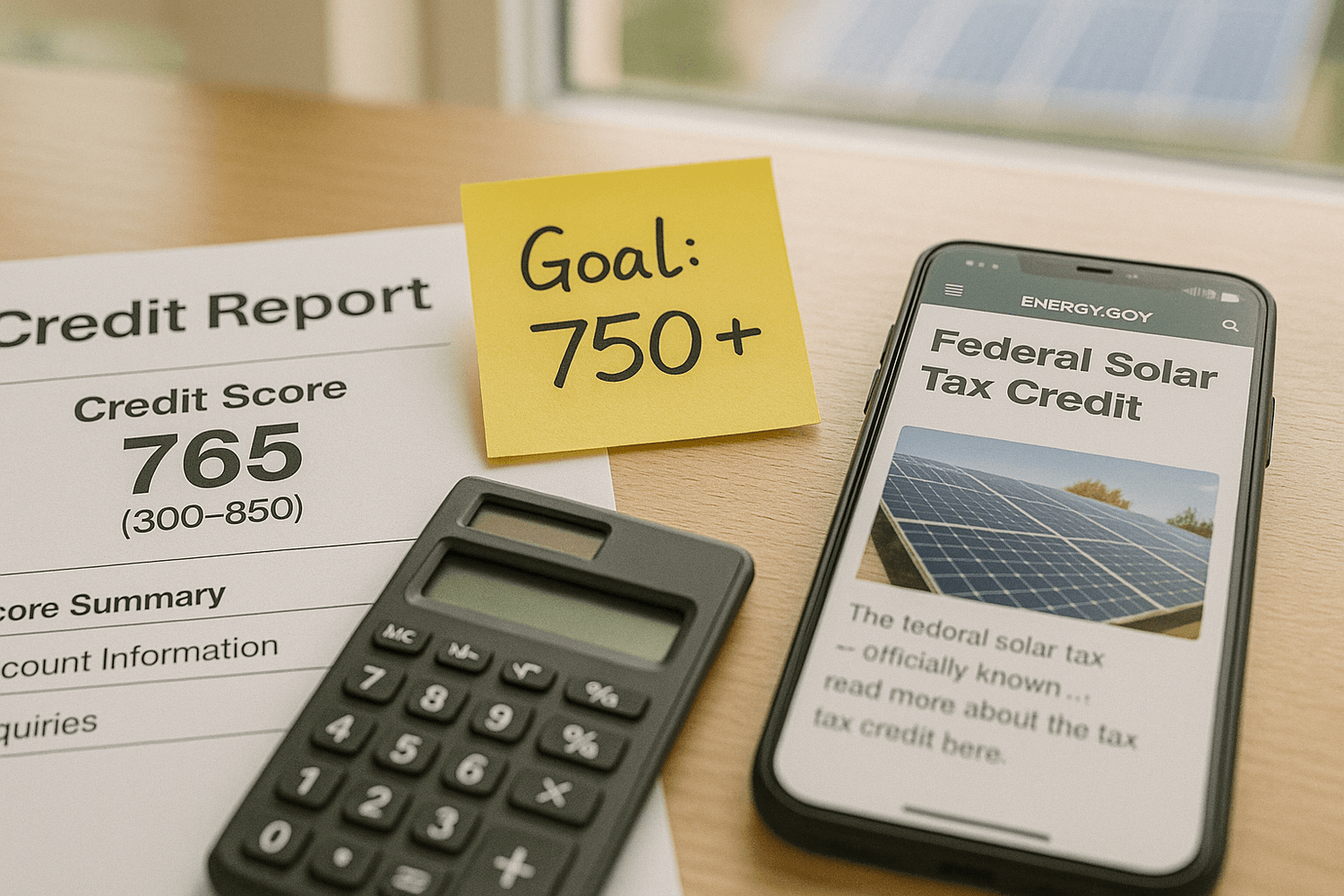

Federal & State Incentives Make It Even Better

Federal Solar Tax Credit (ITC): The U.S. government offers a 30% tax credit for solar installations through 2032. That means if your system costs $15,000, you can get $4,500 back at tax time.

California Solar Programs: Depending on where you live, you may also qualify for rebates or local incentives that reduce your out-of-pocket costs even further.

When you combine these incentives with solar financing, many homeowners find that their monthly solar payment + reduced energy bill is less than their old utility bill.

Real Savings for a California Homeowner

Let’s say your PG&E bill is currently $250/month after the January 2025 rate hike.

Without solar: That’s $3,000 per year, and if rates keep rising 5–10% annually,

you could spend over $40,000 in the next decade just on electricity.

With solar financing:

Your loan payment might be $180/month, while your new PG&E bill drops to around $40/month (for grid connection fees and backup usage).

Net savings: $30/month immediately, and potentially $20,000+ over 10 years.

California Solar Incentives You Should Know

1. Net Energy Metering (NEM 3.0) – Get credits for extra power you send to the grid.

2. Self-Generation Incentive Program (SGIP) – Rebates for adding battery storage to your solar system.

3. Property Tax Exemption – Solar panels won’t increase your property taxes.

4. California Solar Initiative (CSI) – Rebates for eligible low-income households.

Best Solar Loan & Financing Options in California

These providers offer popular $0-down or low-down solar financing used by California homeowners. Compare terms, fees, and eligibility, then apply on each provider’s official website below.

| Provider | Program Type | Typical Terms | Highlights for CA Homeowners | Official Site |

|---|---|---|---|---|

|

Mosaic Solar Loans $0 Down |

Fixed-rate solar loans via contractor network | Commonly up to 25 years; no prepayment penalty (varies by offer) | Streamlined approvals; can bundle batteries/roof with some products | Visit Mosaic |

|

LightStream (by Truist) Personal Loan No Fees |

Unsecured personal loans for solar/home improvement | Approx. 2–12 years; rate based on credit profile | Fast funding; no origination fees; use with any qualified installer | Visit LightStream |

|

Sunlight Financial Solar Loans $0 Down |

Solar/home improvement loans offered through installer partners | Often 10–25 years; flexible payment structures (offer-dependent) | Payment-friendly options; widely used by CA installers | Visit Sunlight Financial |

|

Dividend Finance Solar Loans Storage |

Solar & battery financing; contractor-driven application | Typically up to 25 years; simple digital application | Integrates solar + storage; quick approvals; strong CA presence | Visit Dividend Finance |

|

GoodLeap Solar Loans Green Upgrades |

Financing for solar, batteries, and other sustainable upgrades | Varies by product and installer; fixed monthly payments | Large CA footprint; digital application; supports battery add-ons | Visit GoodLeap |

|

Upgrade Personal Loan Quick Funding |

Fixed-rate personal loans that can be used for solar projects | Commonly 3–7 years; credit-based APRs | Simple online process; can fund smaller systems or add-ons | Visit Upgrade |

Notes: Availability, terms, APRs, and fees vary by credit profile, installer partnership, and location. Always review disclosures on each provider’s official website before you apply.

How $0 Down Solar Works in California

2. Choose a Financing Option – Loan, lease, or PPA (Power Purchase Agreement).

3. Install Solar – No upfront payment required.

4. Start Saving – Your solar bill replaces (and usually beats) your electric bill.

Frequently Asked Questions

Does California still offer solar incentives in 2025

Yes. California homeowners can still take advantage of the Federal Solar Investment Tax Credit (ITC), which gives you 30% off your total solar system cost as a tax credit.

On top of that, many local utilities (PG&E, SCE, SDG&E, LADWP) have financing options and rebates for low-income households.

What are the average electricity rates in California right now?

According to the U.S. Energy Information Administration (EIA), as of 2025, California households pay an average of 29–32¢ per kWh — nearly double the U.S. national average (15¢/kWh). Rate hikes from PG&E and SCE have pushed bills even higher in 2024–2025.

How much can I save with solar financing in California?

With financing (loan or lease), most families save between $60–$120 per month starting from month one. Over the lifetime of your panels, savings can reach $30,000–$80,000, depending on system size and your utility provider.

What’s the difference between a solar loan and a solar lease?

Solar Loan: You own the panels, qualify for the 30% Federal ITC, and build long-term home equity.

Solar Lease/PPA: The solar company owns the panels, and you pay a lower fixed monthly rate for power. No tax credit, but little to no upfront cost.

Do PG&E and SCE customers get special solar programs?

Yes. Both utilities are part of California’s Net Energy Metering (NEM 3.0) policy, where you get credits for excess solar power you send to the grid. While credits are lower under NEM 3.0 compared to older plans, solar + battery storage still provides major bill relief.

How quickly can I get solar installed with financing in California?

Most financing-approved homeowners can get solar installed in 4–8 weeks, depending on permit approvals and installer availability in your city.

Go Solar Now, Pay Later

Solar financing in California means you don’t need a big savings account to start saving.

With $0 upfront, locked-in rates, and massive long-term benefits, switching to solar is one of the smartest financial moves for California homeowners in 2025.

Thinking of going solar and want help quantifying your savings? Get our free eBook on "How to Slash Your Energy Bills with a Solar Generator (Even If You Rent)". Here!

About the author

Emayoma Abbey

Email: info@solarpawa.com

Emayoma Abbey is the founder of SolarPawa.com, a platform dedicated to empowering individuals and communities to embrace clean, reliable, and affordable solar energy. With a strong passion for solving real-world power challenges, Emayoma focuses on providing practical, easy-to-understand information that helps people take control of their energy needs.

ABOUT

SolarPawa is Nigeria's trusted online store for affordable and reliable solar energy solutions.

Created with © Emayoma Abbey