How Financing Makes Solar Affordable Without Upfront Cost in Texas

Texans know energy costs can be unpredictable — especially during scorching summers when AC runs all day, or in winter storms when power grids fail.

But what if you could switch to solar without paying a huge lump sum upfront?

Thanks to solar financing in Texas, homeowners can now enjoy clean, reliable power and lower bills with zero-down payment options.

Whether you live in Dallas, Houston, Austin, or a small rural town, financing makes solar more affordable than ever.

The Cost of Solar in Texas (and Why Financing Helps)

The average cost of solar in Texas is $2.50 to $3.20 per watt before incentives. For a 6kW system, that’s around $15,000–$19,200. While this is cheaper than in many states, it’s still a big chunk of money.

This is where financing steps in. Instead of paying all at once, you can spread the cost into affordable monthly payments, often less than your current electric bill.

Types of Solar Financing Available in Texas

1. Solar Loans

Just like a home improvement loan, you borrow the cost of your solar system and repay in monthly installments.

Pros: You own your solar system, qualify for the 30% federal tax credit, and increase your home value.

Cons: Monthly payments, but often offset by energy savings.

2. Solar Leases

A third-party owns the panels, and you pay a fixed monthly lease fee to use them.

Pros: No upfront cost, no maintenance responsibility.

Cons: You don’t own the system, so no federal tax credit.

3. Power Purchase Agreements (PPAs)

Instead of paying for the equipment, you only pay for the electricity generated at a set per-kWh rate.

Pros: Rates are often lower than utility rates.

Cons: You don’t own the panels.

Best Solar Loan & Financing Options in Texas

Popular $0-down and low-down solar financing options used by Texas homeowners. Compare terms, features, and apply directly via each provider’s official site.

| Provider | Program Type | Typical Terms | Why Texas Homeowners Use It | Official Site |

|---|---|---|---|---|

|

Mosaic Solar Loans $0 Down |

Fixed-rate solar loans through installer partners | Up to 25 years; offers vary by installer & credit profile | Large installer network in Texas; competitive APRs and flexible terms | Visit Mosaic |

|

Sungage Financial Solar Loans Installer Financing |

Loan programs offered through participating contractors | 10–25 years depending on plan | Streamlined approvals and strong presence with Texas installers | Visit Sungage |

|

GoodLeap Green Loans Solar + Storage |

Financing for solar, batteries & home energy upgrades | Varies by product; often 10–25 years | Digital application, large installer network, support for battery add-ons | Visit GoodLeap |

|

Loanpal (formerly Ezra / LoanPal) Solar Loans Fast Approval |

Consumer financing focused on residential solar | Up to 20–25 years; flexible payment options | Fast underwriting and broad installer partnerships across Texas | Visit Loanpal |

|

LightStream (Truist) Personal Loan No Fees |

Unsecured personal loans usable for solar projects | 2–12 years; rates depend on credit | No origination fees, quick funding—good for buyers who qualify | Visit LightStream |

|

Texas PACE Authority PACE Property Loan |

Property Assessed Clean Energy financing (paid via property tax assessment) | Up to 20+ years; repayment via property tax bill | No credit-based underwriting in many programs; transferable with property sale | Visit Texas PACE Authority |

Note: Terms, APRs, and availability vary by lender, credit profile, and installer partnership. Always confirm current offers and disclosures on the provider’s official site before applying. Financing may affect eligibility for certain local incentives—consult your installer or tax advisor for details.

Texas Solar Incentives You Can Stack with Financing

Net Metering – Sell excess energy back to the grid through programs offered by utilities like Austin Energy and Green Mountain Energy.

Local Utility Rebates – Austin Energy offers up to $2,500 in rebates, CPS Energy up to $2,500, and Oncor provides performance-based incentives.

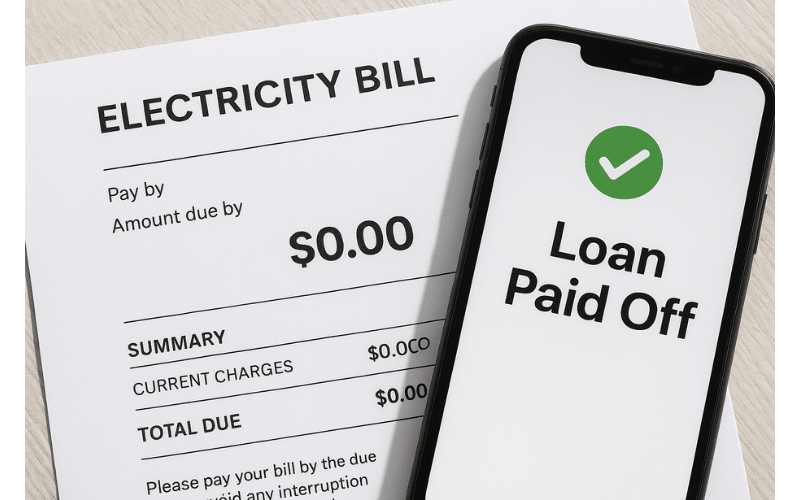

Example: Financing a Solar System in Texas

Let’s say you get a 6kW system for $16,500:

Federal Tax Credit (30%): -$4,950

Net Cost After Credit: $11,550

Financing Plan: $0 down, $120/month for 10 years

Estimated Monthly Savings: $140–$160 on electric bills

Result: Your solar savings cover your loan payments, and after the loan is paid, your power is nearly free.

Frequently Asked Questions

Q1: Is solar financing worth it in Texas?

Yes — with Texas’ abundant sunshine, low equipment costs, and strong incentives, financing can make solar cost-neutral from day one.

Q2: Can I get solar with bad credit?

Some lenders require a credit score of 600+, but PPA or lease options may still be available for lower scores.

Q3: Do Texas solar loans have prepayment penalties?

Most reputable lenders like Mosaic and Sungage do not charge penalties for early repayment.

Q4: Which Texas cities have the best solar incentives?

Austin, San Antonio, and Dallas-Fort Worth areas have strong utility rebate programs.

Texas has everything a solar-powered home needs — sunshine, incentives, and now flexible financing options. If high upfront costs have held you back, zero-down solar loans, leases, and PPAs can help you make the switch today.

Thinking of going solar and want help quantifying your savings? Get our free eBook on "How to Slash Your Energy Bills with a Solar Generator (Even If You Rent)". Here!

About the author

Emayoma Abbey

Email: info@solarpawa.com

Emayoma Abbey is the founder of SolarPawa.com, a platform dedicated to empowering individuals and communities to embrace clean, reliable, and affordable solar energy. With a strong passion for solving real-world power challenges, Emayoma focuses on providing practical, easy-to-understand information that helps people take control of their energy needs.

ABOUT

SolarPawa is Nigeria's trusted online store for affordable and reliable solar energy solutions.

Created with © Emayoma Abbey