Going Solar in Illinois: Costs, Incentives & Step-by-Step Guide (2025 Edition)

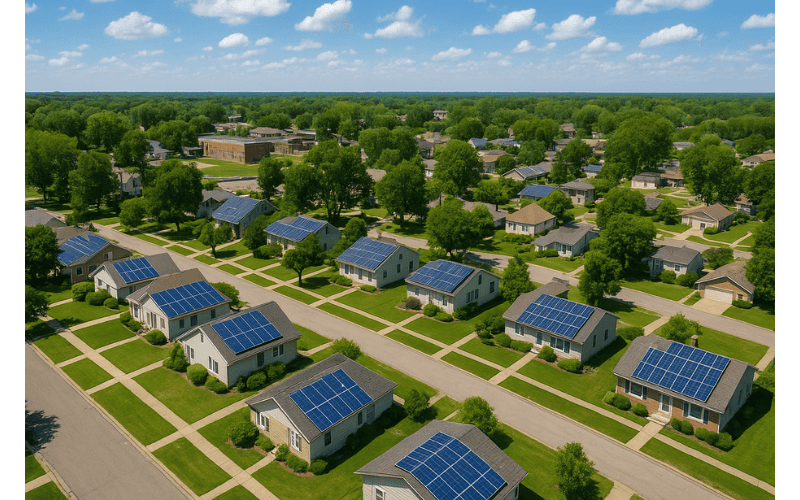

Illinois may be famous for Chicago’s skyline, deep-dish pizza, and unpredictable weather, but the Prairie State is also becoming a major hub for solar power adoption.

While winters can be cloudy, Illinois still receives plenty of sunshine throughout the year — enough to make solar panels a cost-effective, money-saving, and eco-friendly choice for homeowners and businesses.

Whether you’re in Chicago, Springfield, Naperville, or a small town, solar energy in Illinois is not just about going green — it’s about slashing your electricity bills, boosting property value, and taking advantage of generous state and federal incentives.

In this 2025 guide, we’ll break down:

Why going solar in Illinois makes sense

Average solar panel costs in Illinois

Illinois-specific solar incentives & rebates

Step-by-step process to install solar

Financing and loan options for Illinois residents

FAQs about solar energy in Illinois

How to get started today

Why Go Solar in Illinois?

Many people assume solar is only for sunny states like Arizona or California. But Illinois is proof that even in a Midwest climate, solar panels work extremely well.

Here’s why:

1. Electricity Costs Keep Rising – Illinois residents have seen consistent increases in utility rates over the past decade. Solar locks in your own “energy rate” for decades.

2. Net Metering Saves You More – Thanks to Illinois’ net metering law, you can sell excess power back to the grid at retail rates, reducing your monthly bill even further.

3. Generous Incentives – Illinois has some of the most attractive state-level solar programs in the country.

4. Environmental Impact – Switching to solar helps reduce reliance on fossil fuels, lowering your carbon footprint significantly.

5. Energy Independence – No more worrying about utility price hikes or blackouts; solar plus battery storage can keep your home running.

Average Solar Panel Costs in Illinois (2025)

In 2025, the average cost of residential solar panels in Illinois ranges from $2.60 to $3.20 per watt before incentives.

For a typical 6 kW system (enough for many average homes), you can expect:

Gross Cost (before incentives): $15,600 – $19,200

Federal Solar Tax Credit (30%): -$4,680 – $5,760

Net Cost (after federal credit): $10,920 – $13,440

Additional Illinois incentives can drop costs even further.

Payback Period:

Most Illinois homeowners see a payback period of 7–10 years, after which solar power is essentially free for the remaining 15–20 years of the system’s life.

Illinois Solar Incentives & Rebates (2025)

Illinois offers multiple financial incentives that make solar even more affordable.

1. Federal Solar Investment Tax Credit (ITC)

Value: 30% of your solar installation cost

Availability: Nationwide through 2032

How it works: You can deduct 30% of the total cost from your federal taxes.

2. Illinois Shines (Adjustable Block Program)

What it is: A state program that pays you for the renewable energy your system generates in the form of Solar Renewable Energy Credits (SRECs).

How it works: You earn credits for your solar production, which you can sell to utilities.

Savings: Can be worth thousands of dollars over the first few years.

3. Illinois Solar for All Program

Target audience: Low-income households

Benefit: Reduced or no upfront costs for solar installation

Goal: Make solar accessible to all income levels.

4. Net Metering

Utility companies: Ameren Illinois, ComEd, and MidAmerican Energy participate.

How it works: Any excess electricity you generate is credited to your account at retail rates.

Result: Lower electric bills, especially in summer months.

5. Property Tax Exemption

Solar panels don’t increase your property tax even though they raise your home’s value.

Step-by-Step Process to Go Solar in Illinois

If you’re ready to make the switch, here’s the recommended process:

Step 1: Evaluate Your Home’s Solar Potential

Check your roof’s orientation (south-facing is best).

Ensure minimal shading from trees or nearby buildings.

Consider roof age — replacing an old roof before installing solar can save money later.

Step 2: Get Multiple Quotes

Compare at least 3 different installers.

Check if they are NABCEP-certified and have Illinois-specific experience.

Step 3: Understand Your Financing Options

Cash purchase

Solar loan

Solar lease or Power Purchase Agreement (PPA)

State and federal incentives

Step 4: Apply for Incentives

Work with your installer to submit paperwork for Illinois Shines, net metering, and federal tax credit eligibility.

Step 5: Install Your System

Most residential installations take 1–3 days.

Your utility will inspect and connect your system to the grid.

Step 6: Monitor and Maintain

Most systems require minimal maintenance.

Use monitoring apps to track energy production.

Best Solar Loan & Financing Options in Illinois

Below are commonly used $0-down and low-down solar financing programs and lenders for Illinois homeowners. Compare program types, typical terms, and follow each provider’s official site link to check current offers and eligibility.

| Provider | Program Type | Typical Terms | Why Illinois Homeowners Use It | Official Site |

|---|---|---|---|---|

|

Illinois Shines / State Programs State Incentive SREC / Rebates |

State-administered incentive program (SRECs / adjustable block) | Incentive payments tied to production for initial years; varies by block | Provides cash-back or SREC revenue that lowers net cost and improves loan terms | Learn About Illinois Shines |

|

Mosaic Solar Loans $0 Down |

Fixed-rate residential solar loans offered via installer network | 5–25 years (offer dependent) | Competitive APRs, large national installer network including IL contractors | Visit Mosaic |

|

Sunlight Financial Installer Financing Long Terms |

Loan programs offered through certified installers | 10–25 years; multiple payment structures | Flexible long-term options and widely accepted by IL installers for $0-down projects | Visit Sunlight Financial |

|

Dividend Finance Solar + Storage Contractor-Focused |

Solar & battery financing offered via contractor partners | Up to 20–25 years; digital application | Good for combined solar + battery projects; streamlined approvals | Visit Dividend Finance |

|

GoodLeap Green Loans Solar & Storage |

Financing for solar, batteries and other energy upgrades | Varies by product; commonly 10–25 years | Large installer marketplace and easy online application process | Visit GoodLeap |

|

Loanpal Solar Loans Fast Funding |

Consumer-focused solar financing, offered through installers | Up to 20–25 years; flexible payment plans | Quick underwriting and common availability via Illinois contractors | Visit Loanpal |

|

Local Illinois Credit Unions & Community Banks Local Loans Competitive Rates |

Home improvement & green energy loans through local financial institutions | Varies by lender; often competitive when paired with state incentives | Personalized service and often better rates for existing members | Find Local Lenders |

|

PACE Financing (C-PACE / Local PACE Programs) PACE Property Loan |

Property Assessed Clean Energy: repaid via property tax assessment (business & sometimes residential programs) | Often 10–20+ years; repayment through property tax bill | Can enable 100% financing and be transferable on sale (program availability varies by municipality) | Learn About PACE |

Note: Availability, rates, APRs, and program specifics change frequently. Terms depend on credit profile, installer partnerships, county, and whether you combine incentives like Illinois Shines or the Federal ITC. Always verify current offers and disclosures on each provider’s official website and consult a tax professional about incentive eligibility.

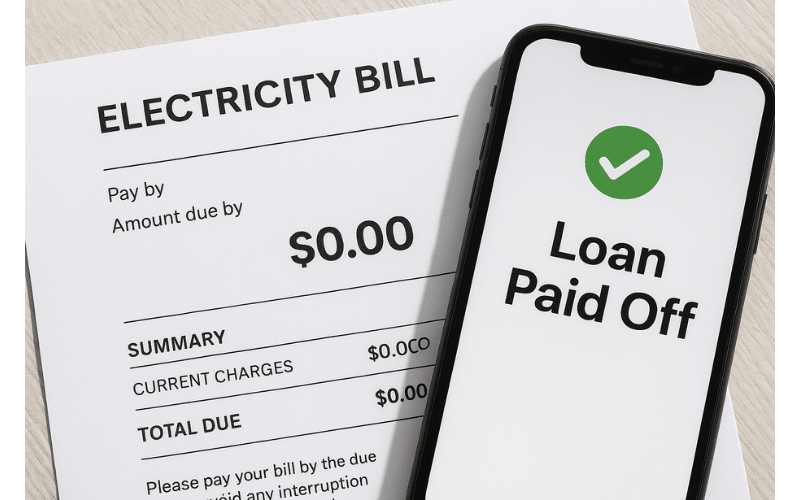

How Much Can You Save with Solar in Illinois?

The average Illinois household uses about 8,000–10,000 kWh per year. With the current average utility rate of around 15 cents/kWh, that’s about $1,200–$1,500/year in electricity costs.

A properly sized solar system can:

Reduce your bill by 80–100%

Save $25,000–$35,000 over 25 years

Increase your home’s value by 4–6%

Frequently Asked Questions

Q: Do solar panels work in Illinois winters?

A: Yes! Even in winter, panels produce electricity as long as sunlight hits them. Cold temperatures can actually improve panel efficiency.

Q: What happens if I produce more electricity than I use?

A: Thanks to net metering, your utility credits your bill for excess production.

Q: Can renters in Illinois get solar?

A: Yes, through community solar programs that let you subscribe to a share of a solar farm’s output.

Q: Will solar increase my property taxes?

A: No — Illinois law exempts solar from property tax increases.

Going solar in Illinois in 2025 is one of the smartest financial and environmental decisions you can make.

Between the federal tax credit, state incentives, and long-term savings, most homeowners can pay off their system in under a decade and enjoy decades of free, clean electricity.

Thinking of going solar and want help quantifying your savings? Get our free eBook on "How to Slash Your Energy Bills with a Solar Generator (Even If You Rent)". Here!

About the author

Emayoma Abbey

Email: info@solarpawa.com

Emayoma Abbey is the founder of SolarPawa.com, a platform dedicated to empowering individuals and communities to embrace clean, reliable, and affordable solar energy. With a strong passion for solving real-world power challenges, Emayoma focuses on providing practical, easy-to-understand information that helps people take control of their energy needs.

ABOUT

SolarPawa is Nigeria's trusted online store for affordable and reliable solar energy solutions.

Created with © Emayoma Abbey