Best Solar Loan & Financing Options in Florida (2025 Guide)

Florida isn’t called the “Sunshine State” for nothing — with more than 230 sunny days a year, it’s one of the best places in the U.S. to go solar.

But while the sun’s energy is free, the upfront cost of installing a solar panel system isn’t. The good news? You don’t need to pay for everything out-of-pocket.

There are multiple solar loan and financing programs in Florida that make switching to solar both affordable and profitable in the long run.

This guide will walk you through the best solar financing options in Florida, explain how they work, and help you choose the right one for your budget and goals.

Why Consider Solar Loans in Florida?

Florida homeowners have unique advantages when it comes to financing solar:

No state income tax — keeps more savings in your pocket.

Strong sunshine — means higher energy production and faster ROI.

Net metering programs — credit you for excess energy sent to the grid.

Federal solar tax credit — lets you deduct 30% of your system cost from your federal taxes.

With financing, you can start saving on energy bills immediately without waiting years to save up for a cash purchase.

Types of Solar Financing in Florida

1. Solar-Specific Loans

Loans designed for solar systems often come with lower interest rates and flexible repayment terms (usually 5–20 years).

2. PACE Financing (Property Assessed Clean Energy)

Florida is one of the states with active PACE programs, allowing you to pay for your system through property taxes. No upfront payment required, and the loan stays with the property if you sell.

If you have significant home equity, this can be a great way to secure low-interest financing for solar.

4. Solar Leasing & Power Purchase Agreements (PPA)

While less common in Florida compared to loans, leasing can be an option if you want lower upfront costs but don’t mind not owning the system.

Best Solar Loan & Financing Options in Florida

Top $0-down and low-down solar financing options commonly used by Florida homeowners. Compare program types, typical terms, and apply directly via each provider’s official website below.

| Provider | Program Type | Typical Terms | Why Florida Homeowners Use It | Official Site |

|---|---|---|---|---|

|

Mosaic Solar Loans $0 Down |

Fixed-rate solar loans through installer partners | Up to 25 years; offer specifics vary by installer & credit profile | Competitive APRs; used by many Florida installers for $0-down offers | Visit Mosaic |

|

Sungage Financial Installer Financing Solar Loans |

Loan programs offered through participating contractors | 10–25 years depending on plan | Streamlined approvals; many Florida installers offer Sungage-based financing | Visit Sungage |

|

GoodLeap Green Loans Solar + Storage |

Financing for solar, batteries & home energy upgrades | Varies by product; often 10–25 years | Large installer network in Florida; user-friendly digital application | Visit GoodLeap |

|

Sunlight Financial Solar Loans Installer Partners |

Loan & financing solutions offered via contractor network | 10–25 years; flexible payment structures | Competitive long-term options and strong installer partnerships in Florida | Visit Sunlight Financial |

|

Ygrene (PACE) PACE Financing No Upfront |

PACE: Repaid via property tax assessment (where available) | Often 10–25 years; repayment added to property tax bill | No credit-based underwriting in many programs; transferable at sale of property | Visit Ygrene |

|

Loanpal Solar Loans Fast Funding |

Consumer-focused solar financing with wide installer network | Up to 20–25 years; multiple payment options | Fast underwriting, commonly offered by Florida solar contractors | Visit Loanpal |

|

LightStream (Truist) Personal Loan No Fees |

Unsecured personal loans usable for solar projects | 2–12 years; rates based on credit score | No origination fees and quick funding for qualified borrowers | Visit LightStream |

Note: Terms, APRs, availability, and eligibility vary by lender, credit profile, and installer partnership. PACE availability differs by county and municipality in Florida. Always confirm current offers and read disclosures on the provider’s official site before applying. Consult your tax advisor about how financing and incentives (like the federal ITC) apply to your situation.

How to Choose the Right Solar Financing in Florida

When comparing options, look at:

Interest rate (APR) — lower means cheaper over time.

Loan term length — shorter saves more interest, longer means lower monthly payments.

Eligibility requirements — PACE doesn’t require credit checks; loans do.

Ownership benefits — loans let you keep tax credits; leases/PPA don’t.

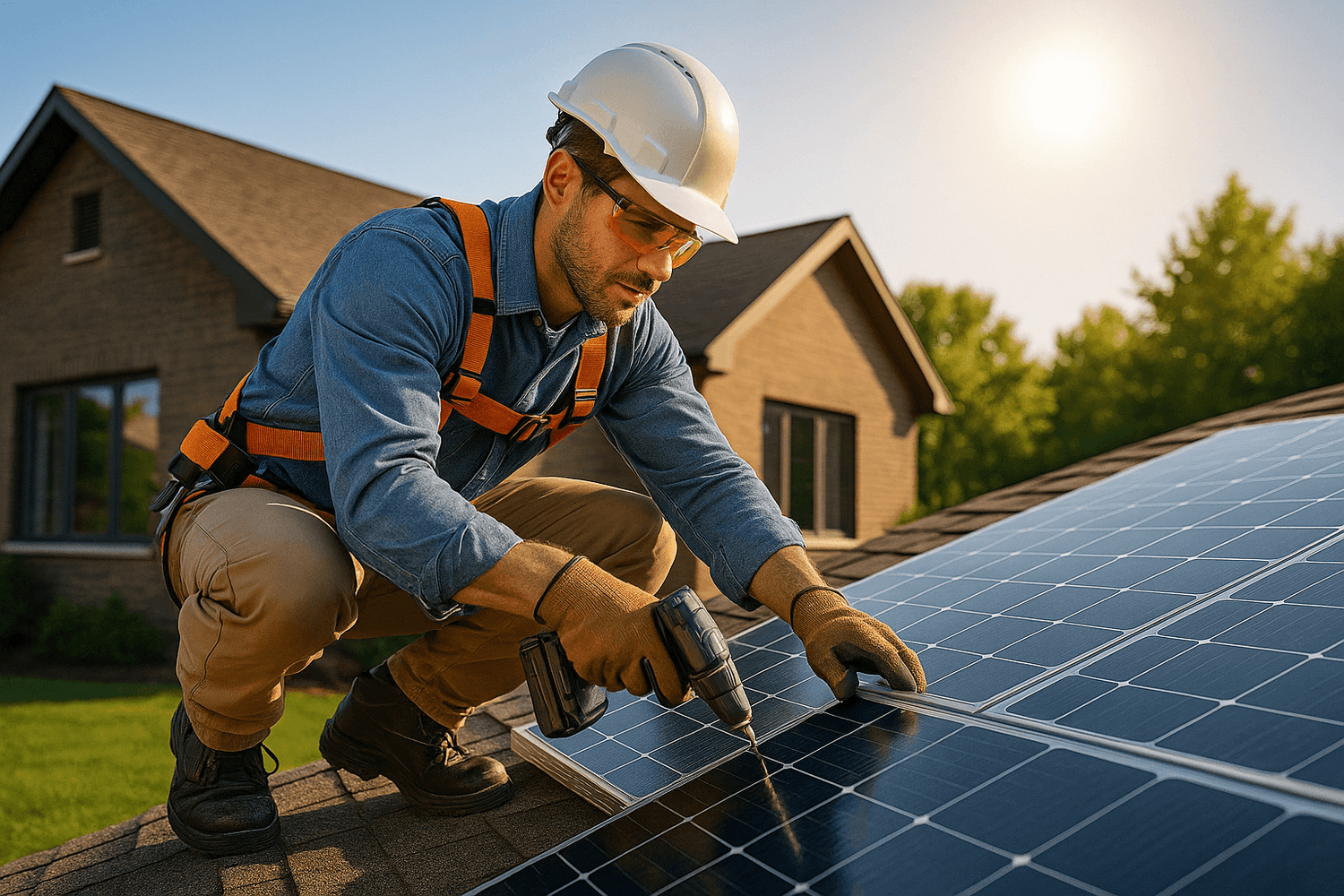

Steps to Apply for Solar Financing in Florida

1. Get Multiple Solar Quotes – Compare system sizes, equipment, and prices.

2. Check Incentives – Apply for the Federal 30% Solar Tax Credit and any utility rebates.

3. Choose Financing Type – Decide between PACE, loan, or lease.

4. Apply & Get Approved – Approval can take from a few hours to a week.

5. Install & Start Saving – Enjoy lower electricity bills and energy independence.

Frequently Asked Questions

Q: Is PACE financing available everywhere in Florida?

A: Not every county participates in PACE programs, so check with your local authority before applying.

Q: Do solar loans in Florida require a down payment?

A: Many providers offer $0-down options, especially for qualified homeowners.

Q: Can I still get the Federal Tax Credit with financing?

A: Yes, as long as you own the system (loan or cash purchase). Leasing/PPA customers do not get the credit.

Q: How much can I save with solar in Florida?

A: Depending on your system size, location, and electricity rates, savings can exceed $20,000 over the system’s lifetime.

Florida’s sunshine and supportive financing options make going solar a smart move in 2025.

Whether you choose PACE financing, a solar-specific loan, or a home equity line, there’s a way to make your solar investment work for your budget.

The key is to compare providers, understand the terms, and take advantage of every available incentive.

Thinking of going solar and want help quantifying your savings? Get our free eBook on "How to Slash Your Energy Bills with a Solar Generator (Even If You Rent)". Here!

About the author

Emayoma Abbey

Email: info@solarpawa.com

Emayoma Abbey is the founder of SolarPawa.com, a platform dedicated to empowering individuals and communities to embrace clean, reliable, and affordable solar energy. With a strong passion for solving real-world power challenges, Emayoma focuses on providing practical, easy-to-understand information that helps people take control of their energy needs.

ABOUT

SolarPawa is Nigeria's trusted online store for affordable and reliable solar energy solutions.

Created with © Emayoma Abbey